Three Reasons to Outsource ATM Services

The last year has led to many unprecedented changes in the banking industry. Prior to the COVID-19 pandemic, there were still many banks and credit unions that would service their own ATMs which leaves the ATM and bank’s employees open to an extremely high-risk situation. In conjunction with the pandemic, we have seen an increase of overall ATM robberies in metropolitan areas across the world. While many financial institutions have made adjustments to discourage robberies like adding GPS tracking to cassettes and safety gates around ATM kiosks, many continue the risky practice of filling and maintaining their own ATMs. Here are three reasons why outsourcing to a cash management partner can save on time and resources while keeping your staff safe.

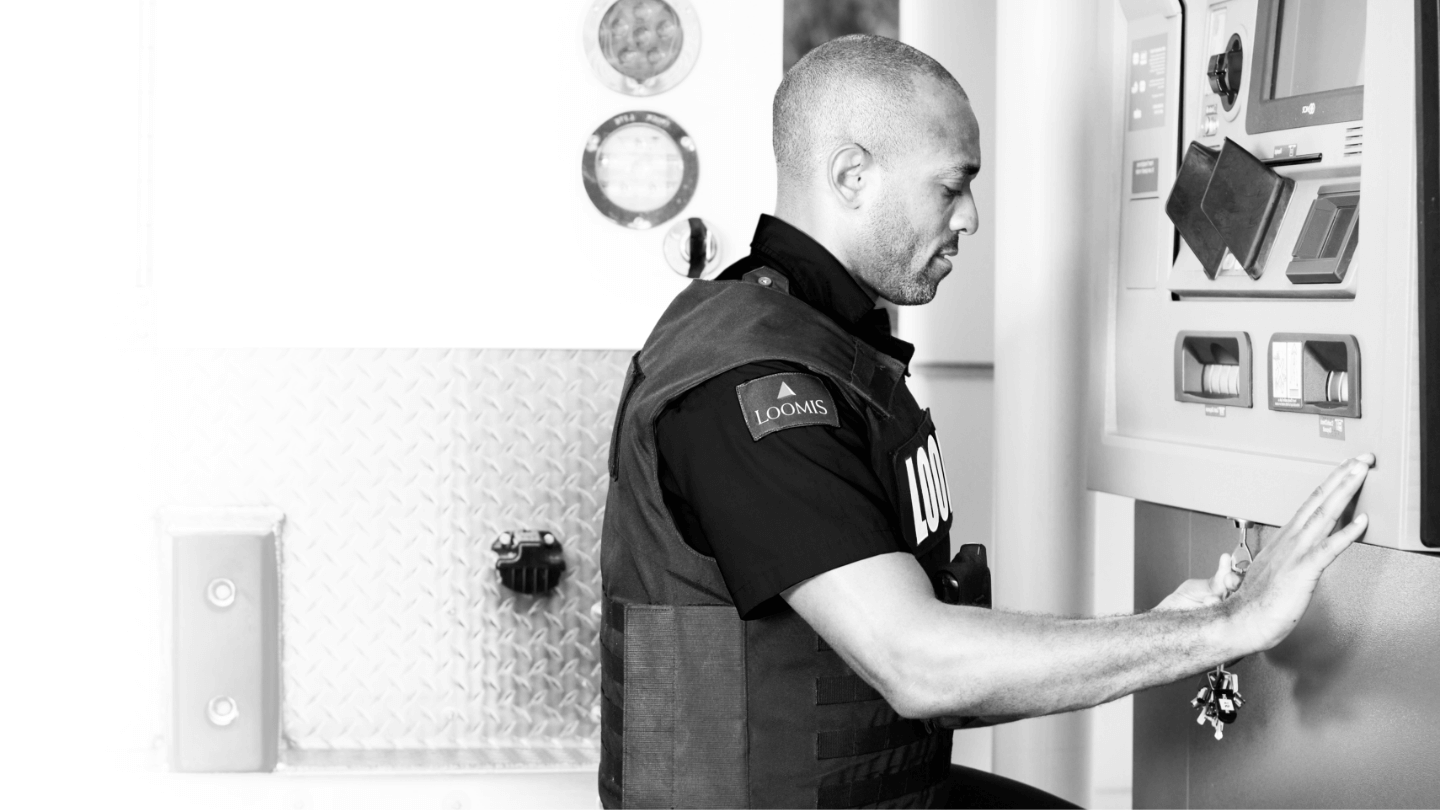

1. Lowers risk to bank employees.

It is no secret that drive up ATMs are most dangerous when the ATM is open. According to Lowers & Associates’ analysis of U.S. ATM robbery trends from 2008 – 2017, 89% of U.S. ATM robberies against armored carriers over the last 10 years have included the use of violent force. This statistic reflects attacks against trained armored car carriers so we can interpret that the risk for bank employees that self-service their ATMs are at even higher risk of injury. By using a cash management partner to service your bank or credit union’s ATMs you will be hiring trained professionals that are armed and trained in various scenarios to handle potential threats, lowering risk of harm to your employees and customers.

2. Saves on time and resources.

Although your team members may be able to service your own ATMs it doesn’t mean they should. Not only does it make your employees and ATMs extremely vulnerable to theft, but allocating time and budget to training your employees in ATM replenishment can still lead to under-preparedness and dangerous situations, as well as waste valuable resources. In addition, outsourcing your ATM replenishment allows your employees to have more time to focus on tasks that help the financial institution run more efficiently and promotes revenue growth through securing more customer depository accounts and loans.

Something else you should consider if you happen to be a part of your institution’s risk department is the potential for miscommunication internally. This was especially important for banks and credit unions during the COVID-19 pandemic with branches across the country shutting down and re-opening at different times. For example, your operations department might decide that ATMs will be serviced by the armored car carrier during temporary closings and self-serviced during openings, but you might be unaware of this. This creates added risk that isn’t being taken into consideration and impacts the effectiveness of your role in the risk department.

3. Improves overall efficiency and cash operations.

During COVID-19, many financial institutions that previously self-service ATMs began to outsource their ATM servicing and cash management to armored car carriers when states went into lockdown and branches had to close while their drive thru and ATMs were still open. Many financial institutions found that outsourcing their ATM servicing lowered the financial institution’s liability while increasing their overall efficiency surrounding their cash operations.

As previously mentioned, ATM robberies increased over the last year. Many ATM service providers stepped up to help banks and credit unions lower their liability while keeping their cash operations running smoothly to meet customer demand. One of the ways providers helped financial institutions is by applying the Just in Time (JIT) inventory method to ATM management for specific ATMs. The JIT method works to lessen the volume of cash on hand. This method predicts that banks and credit unions can reduce waste and save money by only carrying enough inventory to meet customer demand based on accurate forecasting. Using the JIT method has lowered the amount of cash that banks keep in their ATMs and lowers the amount of time armored car carriers spend at ATMs, and ultimately reduces liability and risk to the financial institution.

These are just a few of the reasons why most financial institutions have decided that investing in a cash management partner is well worthwhile in order to avoid the potential collateral damage and brand impact that could result from an incident. Make sure to look for a cash management partner with comprehensive solutions for replenishment, settlement, pickup, processing, maintenance, and forecasting. In addition, they should offer a wealth of industry best practice knowledge and training to ensure you get the most efficient service, and that your people and assets remain secure.

Find out how we can help with your cash management.

Contact Us