How to Increase Cash Transparency in Your Bank’s Supply Chain

Bank and credit unions have some of the most intricate and heavily involved supply chain systems in the world. The main influence is the increased use of more sophisticated technology such as ATMs, video tellers, recyclers, and kiosks. The truth is, financial institutions and retailers have similar supply chains, and retail products and currency move in a very similar way through the supply chain. However, banks and credit unions run into many challenges in understanding their cash supply chain because there is generally a lack of cash transparency within the organization as most departments involved work in siloes and do not communicate.

While banks and credit unions continue to adopt more technology to better customer experience, it is equally important that they have visibility and insight into this more complex cash supply chain and overcome cash transparency challenges. Supply chain management (SCM) cloud software is used by almost every other industry today to increase overall transparency in the organization, and banks and credit unions are behind the times in adopting this technology. In this post, we discuss three features banks and credit unions should look for in a SCM cloud software that would help improve cash transparency across the entire enterprise.

1. Cash Forecasting

The first feature you should ensure a SCM software has is forecasting capabilities. Remember, almost every other industry is leveraging forecasting tools to keep enough inventory on the shelf to meet customer demand while keeping storage costs low. The same principle can be applied to currency. A cash forecasting tool allows your financial institution to order cash based on historical data and actual cash demand and usage down to the denomination level at every cash end point, so you don’t have extra cash sitting idly in vaults, but still have enough cash to meet customer demand in a specific branch or drive-thru ATM.

A forecasting software also increases cross-departmental communication by providing each department involved in the cash supply chain insight and visibility into cash usage across the organization. Lastly, a cash forecasting feature increases cash transparency by changing the way a bank or credit union places a cash order. Banks and credit unions can choose whether to use a decentralized approach, where each branch manager is responsible for ordering their own cash, or a centralized approach, where one person orders the cash for all branches based on forecasting.

2. Armored Car Carrier Integrations

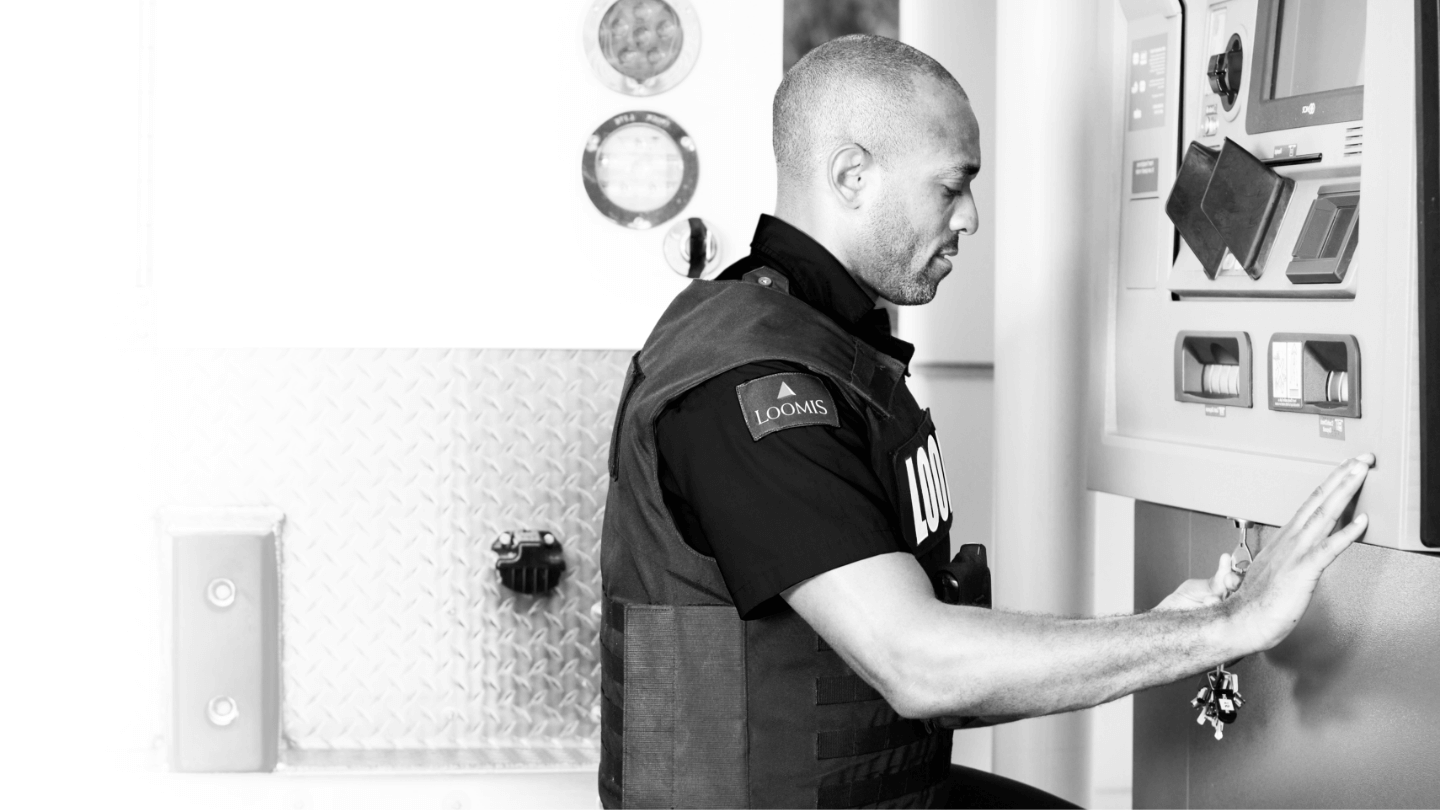

Another feature banks and credit unions should look for in a SCM cloud-based software is integrations with armored car carriers. Not only does this allow your financial institution to place cash orders directly to your armored car carrier in the same software that is forecasting the cash, but it also allows them to make updates to cash orders or place emergency shipments. For example, during the early stages of the COVID-19 pandemic, many banks and credit unions had to temporarily shut down their branches and had to rely on their armored car to service their drive-thru ATMs that they normally would have serviced themselves. Banks and credit unions that were using a SCM software with an armored car integration were easily able to place their orders remotely to ensure their ATMs were still being serviced on schedule. Another benefit to having an armored car carrier integration in your SCM software is that it allows you to optimize delivery and pick-up schedules based on cash demand and cash-in-transit which minimizes fulfillment costs.

3. Real-Time Reporting and Analytics

The last feature you should look for to help improve cash transparency across your organization is real-time reporting and analytics. It is important to be able to look at your SCM software and understand each location’s current cash position at any given moment. It is recommended that you can run reports that allow you to see cash demand and usage over a specific time frame, in addition to how much cash was ordered. This ensures that your branches are not running out of cash, but not holding extra cash. In addition, this type or reporting allows you to have visibility into potential outlying events that could impact your cash order. For example, we saw with the COVID-19 pandemic that there was a huge initial spike with customers and members taking more cash out of ATMs than what normally would have been forecasted. However, as vaccines continue to roll out and everyone adjusts, many banks and credit unions have been able to look at cash usage analytics to decide if they should continue to keep more cash at their branches, or if cash levels have normalized and they can return to ordering based on historical usage.

The cash supply chain continues to increase in complexity as financial institutions choose to undergo digital transformation and adopt more cash technology to better serve customers and members. Therefore, a SCM software with forecasting capabilities, armored car integrations, and real-time reporting is vital to increasing cash transparency and overall, the institution’s success.

Find out how we can help with your cash management.

Contact Us