How Cash Management Enhances Both Commercial Businesses and Treasury Management

With trillions of dollars of cash in circulation worldwide, and with a constantly evolving (and sometimes unpredictable) economic landscape, cash management is becoming more of a priority for commercial businesses. The efficacy of cash management solutions, such as smart safes and cash in transit, is well documented, and business owners have their pick of providers offering different levels of service. But with 82 percent of small and medium-size businesses failing due to poor cash management, choosing the right cash management partner, one that brings more than just trucks and safes to the table, is paramount. The right approach to cash management is one that combines cutting-edge technology with a high level of service and expertise. Commercial businesses aren’t the only ones who stand to benefit from implementing cash management. There are also significant advantages for Treasury Management at financial institutions of all sizes.

What are the benefits for commercial businesses?

When commercial businesses rely on manual or outdated cash-handling processes, it can hurt operations and make the business more vulnerable to risks. The numerous touch points associated with these processes—counting, recounting, reconciling, depositing, and delivery to a bank—slow down operations and often require additional employee training. Unfortunately, too many touch points also create more opportunities for internal theft. Having too much cash on hand creates a liability for employees and customers alike. And without a cash management solution in place, business owners and operators might not have visibility of their accounts to even know where money is being lost.

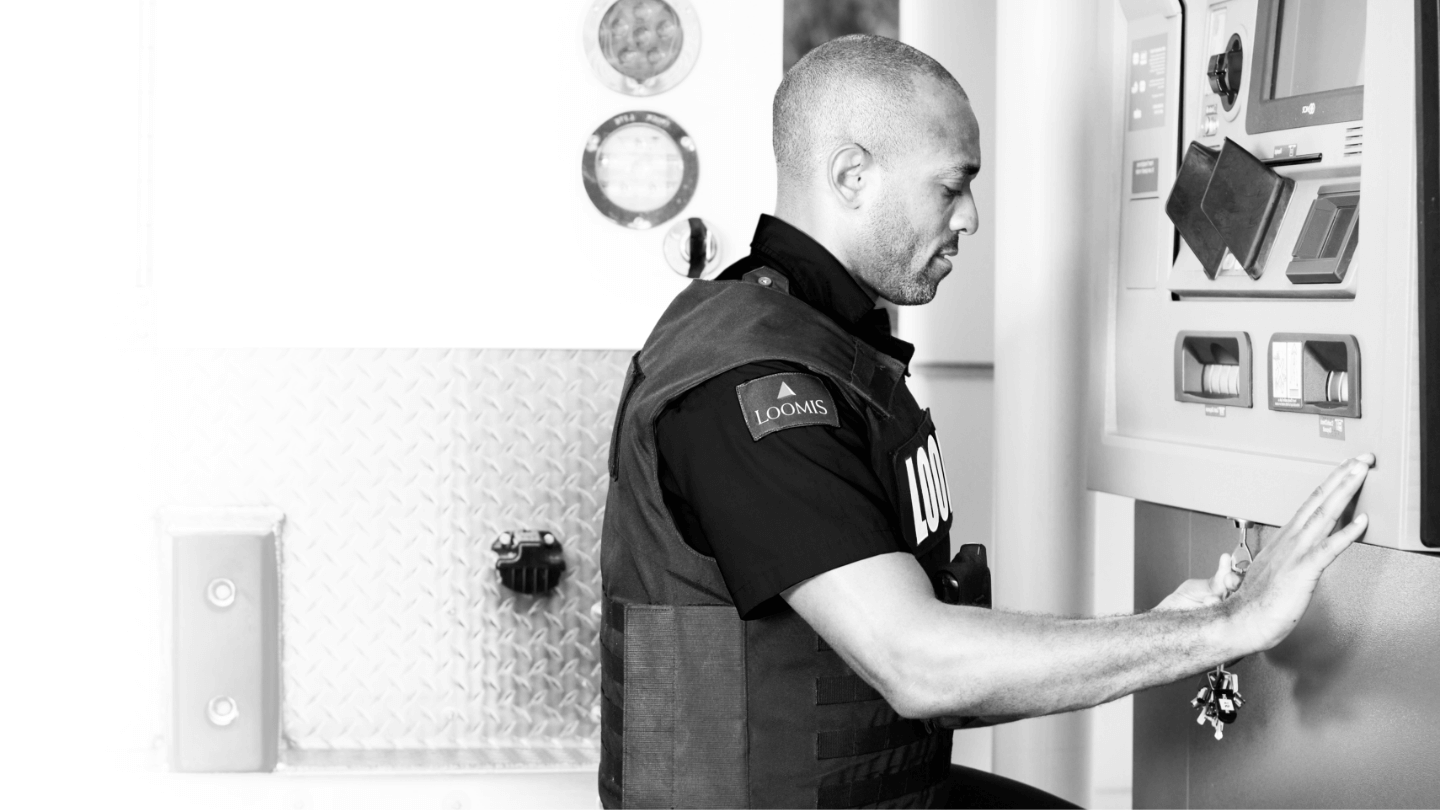

Cash management provider can help mitigate all these issues. For example, a smart safe vastly reduces the number of touch points in cash processes. Built-in features, such as tutorials and remote monitoring, help simplify internal processes, reducing training time or the need for maintenance visits from technicians. An advanced smart safe may also have provide business owners the ability to assign employees individual PINs, which makes all safe activities completely traceable and keeps employees accountable. The smart safe in combination with a customizable cash-in-transit service plan helps ensure that cash amounts are always at the optimum levels, which helps reduce liability to employees and customers.

Technologically driven cash management solutions also provide business owners with faster, more accurate visibility of accounts. This and faster access to cash, thanks to the cash management provider’s provisional banking relationships, allow business owners to make better decisions and reinvest funds in the business.

What are the benefits for treasury management?

Cash management’s benefits for commercial businesses is well documented. But financial institutions’ Treasury Management also stands to gain from a client implementing a comprehensive cash management approach.

Cash-in-transit schedules and smart safes help reduce in-branch foot traffic and limit the amount of funds in the bank at any given time, which helps reduce risks to both customers and employees. This also allows the financial institution to divert labor and resources to more lucrative aspects of the business, such driving other product sales. When commercial clients make deposits into a smart safe, those funds are provisionally credited to the business’s bank account. The financial institution can then use those funds to produce more loans and investments and maximize the returns of reserves on hand. Perhaps most importantly, knowledge of the broader cash management landscape can position Treasury Management teams as informed thought leaders and help diversify offerings. Being able to intelligently promote cash management solutions helps Treasury Management start new conversations with clients in an advisory capacity and potentially expand the commercial portfolio. Promoting solutions that save businesses money and maximize return on investment can help strengthen client relationships.

There is no cookie-cutter approach to cash management. Commercial businesses need to partner with providers that offer tech-forward, configurable solutions and top-notch service and support that position them for success. Meanwhile, Treasury Management should enhance their knowledge of cash management trends to create opportunities with current and future clients.

Find out how Loomis can position your commercial business or financial institution for success with technology-drive cash management solutions.

Find out how we can help with your cash management.

Contact Us