2024 Minimum Wage Increases: Businesses Prepare for Change

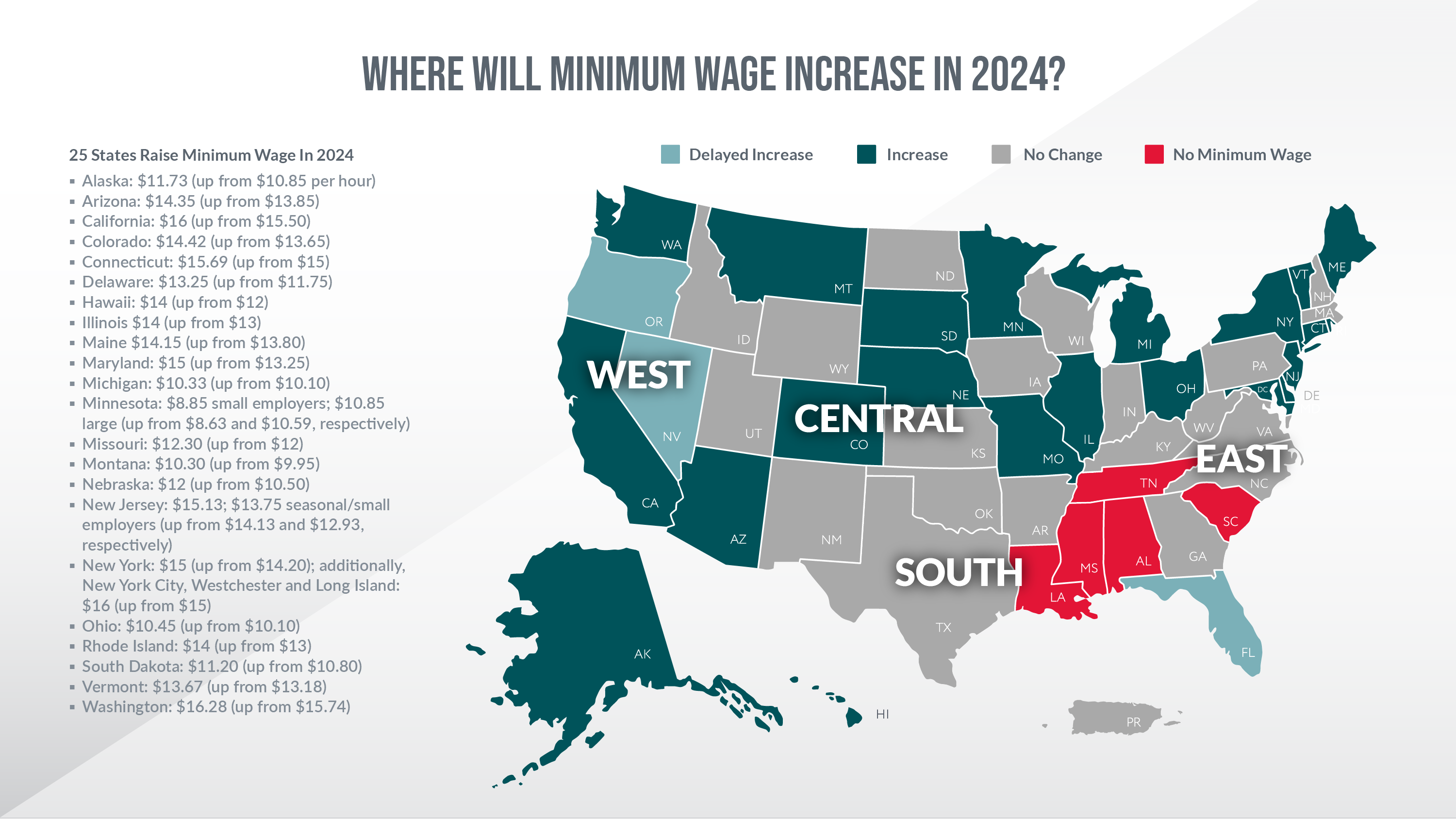

As 2024 unfolds, changes to the business climate are already underway as nearly half of the US adjusts to minimum wage increases. Twenty-two states have already implemented new minimum wage standards, while three other states are set to follow suit later this year.

The new wage increases vary by state, with some states increasing by half a dollar like in California and Missouri, while others rose considerably, like Hawaii with a $2 minimum wage increase. Washington currently stands as the state with the highest minimum wage, at $16.28/hr., not including Washington, D.C.’s $17/hr., which has yet to increase in 2024.

Impact on Business

The shift in minimum wage standards has impactful implications for businesses across various sectors. While the intention is to provide fair compensation for workers, the reality is that businesses, especially small and medium-sized enterprises, face challenges in adjusting to higher labor costs. These challenges include increased operational expenses, a potential need to raise prices, and a reevaluation of staffing levels.

Small businesses in particular may find it challenging to absorb the increased costs of higher wages. The adjustments required to comply with new wage standards can strain budgets, potentially affecting profitability and long-term sustainability. Additionally, as wages rise, businesses may also witness changes in consumer spending patterns, influencing the demand for goods and services.

The Link Between Rising Minimum Wage and Inflation

One consideration amid minimum wage increases is the potential impact on inflation. As businesses incur higher labor costs, there is a likelihood of these costs being passed on to consumers in the form of increased prices for goods and services. This ripple effect contributes to a broader economic phenomenon – inflation.

Inflation, defined as the sustained increase in the general price level of goods and services, can lead to a decrease in the purchasing power of consumers. As businesses adjust prices to compensate for rising wages, individuals' living costs also rise. This interconnected relationship between rising minimum wages and inflation underscores the complexities businesses face in maintaining financial equilibrium.

Reducing Labor Hours Without Sacrificing Efficiency

As businesses confront the dual challenges of rising wages and inflation, there is a way for operators to save time and money: SafePoint by Loomis. By automating cash-related tasks, SafePoint significantly cuts down on labor hours, offering an alternative to traditional processes such as manual bank runs. This efficiency-driven approach not only optimizes operations but also directly addresses the hurdles posed by escalating wage pressures. SafePoint also reduces risk by keeping employees safe in-store, and cash protected throughout the entire cash cycle.

Industry Leaders on the Inflation-Crime Nexus

While a significant portion of the country adapts to changes in minimum wage and subsequent inflation, business owners should keep a close eye on the domino effect that can lead to increased crime in states where the effects of inflation loom large. Luckily, Loomis plays a pivotal role in safeguarding its clients against the risks posed by inflation-driven crime.

John Barrett, EVP of Sales & Marketing at Loomis, draws attention to the broader repercussions of inflation.

Barrett highlights how Loomis actively deploys innovative technologies to counteract the potential rise in criminal activities associated with economic uncertainties. This commitment to crime deterrence is vital, not just for the safety of Loomis teammates and the continuous operation of armored car routes, but also for the protection it affords customers.

"Inflation drives crime," Barrett said, “Deterrence is crucial as it safeguards our teammates, ensuring their safety and the continuity of our routes, and protects our customers, their people, property, and profits from the impact of criminal activities.”

McKay Barnes, EVP of Business Development at Loomis, provides insights into how SafePoint, an automated cash management solution, addresses the challenges businesses face in the wake of rising minimum wages and labor pressures.

“Our SafePoint offering, it really allows the employees and managers to focus on running their business and taking care of their customers instead of leaving the store to deposit cash and get change from the bank,” said Barnes, “It takes the cash out of employees' hands.”

SafePoint allows employees and managers to focus on running their businesses and taking care of clients by automating cash-related tasks. This reduces downtime and minimizes risks associated with handling cash.

Barnes also emphasizes how SafePoint enhances visibility and expedites the deposit process, ensuring that businesses can swiftly access liquidity. In an environment marked by rising wage pressures, SafePoint has become a critical tool for businesses looking to streamline operations, improve efficiency, and manage their cash more effectively.

SafePoint—A Strategic Ally for Businesses

As businesses navigate the challenges posed by increasing minimum wages and inflation, SafePoint emerges as a strategic ally. By providing a secure, automated solution for cash management, SafePoint enables businesses to remain focused on growth, customer engagement, and operational efficiency. Are wage increases and inflation subjects of concern for your business? Contact Loomis for expert help.

For more information on up-to-date minimum wage laws per state, visit the U.S. Department of Labor.

Find out how we can help with your cash management.

Contact Us