Loomis has issued SEK 1,000 million of Sustainability-Linked Bonds

The bonds will be listed on the Nasdaq Stockholm Sustainable Bond List. The sustainability-linked bonds are issued under Loomis' recently updated MTN program and under Loomis' Sustainability-Linked Financial Framework, which is published on https://www.loomis.com/en/investors/bond-market.

In connection with the new issue, Loomis AB also has bought back SEK 174 million of the outstanding bonds with maturity on the 18th of September 2023 (SE0011869932). The price for the notes was set to 100.095 per cent of the nominal amount per note and settlement date will be the 19th of May 2023. Loomis will also pay accrued and unpaid interest from, but excluding, the previous interest payment date until, and including, the settlement date.

Loomis has linked the sustainability-linked bonds to the outcome of a sustainability performance target to reduce Loomis' absolute carbon dioxide emissions with 20 percent by 2025, compared to the 2019 level. Danske Bank and Nordea jointly acted as bookrunners for this issue.

About Loomis U.S.

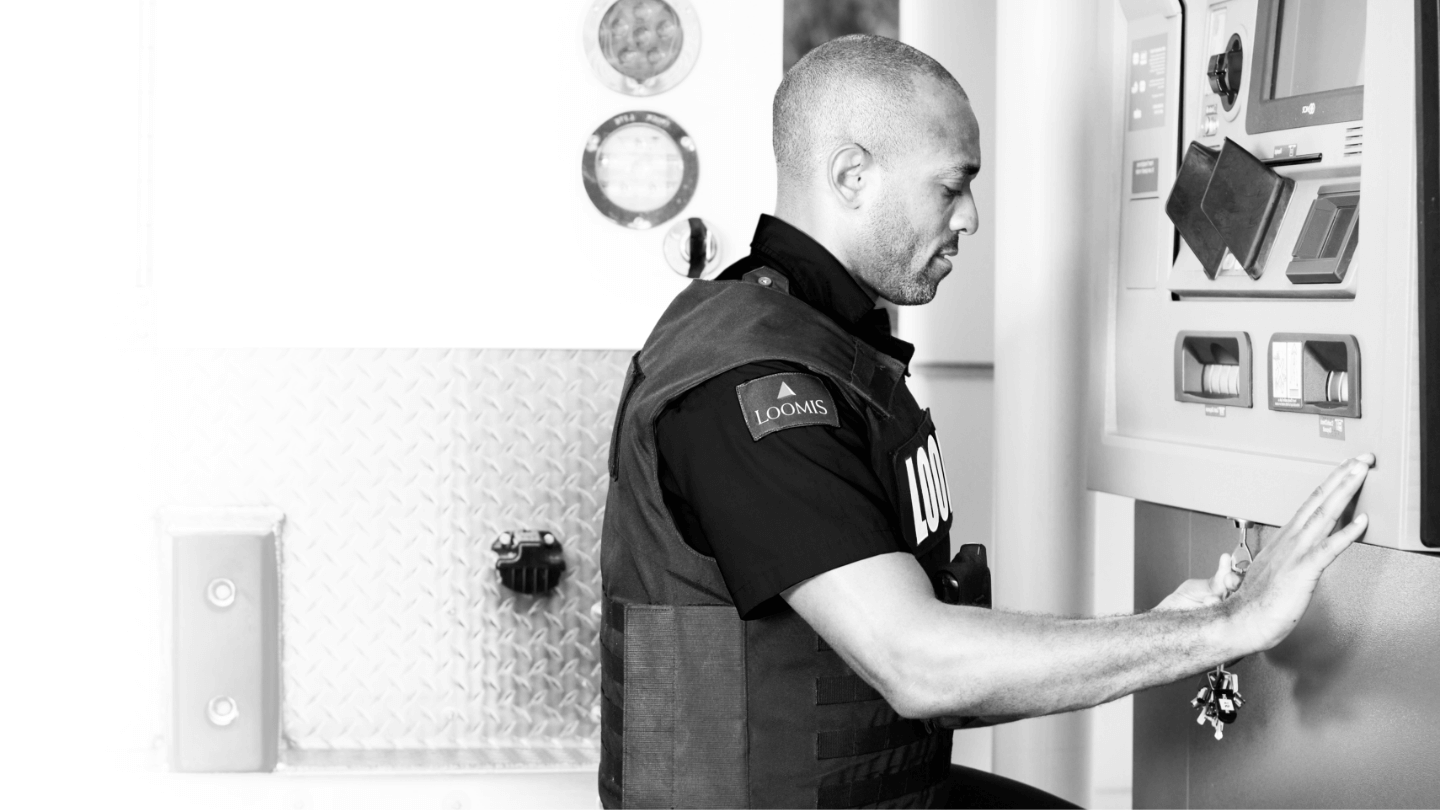

As a leader in cash distribution across the United States – with nearly 200 branch locations, 11,000 employees, 3,200+ vehicles, and nearly 50,000 SafePoint locations serviced—Loomis is proud to provide cash handling products and services to financial institutions and commercial/retail businesses nationwide. Learn more at loomis.us.

Find out how Loomis can help you cut costs while improving security and accuracy.

Contact Us